Ninety percent of sellers hire the first agent they talk to. Think about that: If you can be the first agent that 10 prospects speak with, you could turn those conversations into 9 new clients.

That begs the question: “How do I get in front of sellers before my competitors?” The answer is by using the All-New Homesnap Pro.

Remember: You must be logged into your Homesnap Pro account to access these agent-only features.

Homesnap Pro is an included MLS benefit, and its latest update gives you an advanced set of new tools so you can find seller leads intelligently and quickly. Then, you can more narrowly target the homeowners who are most likely to put their home on the market soon.

Homesnap’s team of data scientists spent months perfecting a sophisticated algorithm, creating a new Likelihood to List score that combines a bevy of data points to determine which homes are most likely to list soon. The scores are broken down into three levels:

1. MOST LIKELY

These will be the likeliest homes to go on the market in the next 12 months. These homes will be marked in orange when you search using the Likelihood to List heatmap.

2. LIKELY

These are homes that have some signals that point to a listing in the next year. These homes will be marked in yellow on the heatmap.

3. LEAST LIKELY

These are homes that are unlikely to go on the market in the coming year. These homes will be marked in blue on the heatmap.

There’s a common saying in the real estate world that every house is for sale — meaning that it’s always worth having a conversation with a homeowner to gauge their unique situation and what circumstances would prompt them to sell. That’s what prospecting is all about, but the old-school tactics of cold-calling and cold-door-knocking are inefficient if not done strategically.

When you prospect using Homesnap Pro’s new Likelihood to List scores, in addition to its catalog of other new property search filters, you’re plugging into the most powerful pieces of prospecting while leaving behind the inefficiencies.

This is data-backed prospecting that points you in the right direction, so you aren’t spending your precious marketing dollars blanketing an entire neighborhood in postcards and flyers when you could just focus on a handful of relevant properties.

And beyond steering you in the right direction, the All-New Homesnap Pro provides a wealth of information on each property. In addition to real-time MLS data, you can see tax records, mortgage histories, deeds, and other historical information that can give you a fuller picture of the property.

You can also access homeowner profiles on every property, so you can instantly call, email, or text a seller lead. That puts you at a significant advantage, and it’s all free to you as an MLS benefit.

In order to make the most of the All-New Homesnap Pro, here’s how you can find seller leads:

1) First, establish your stipulations in the search filters.

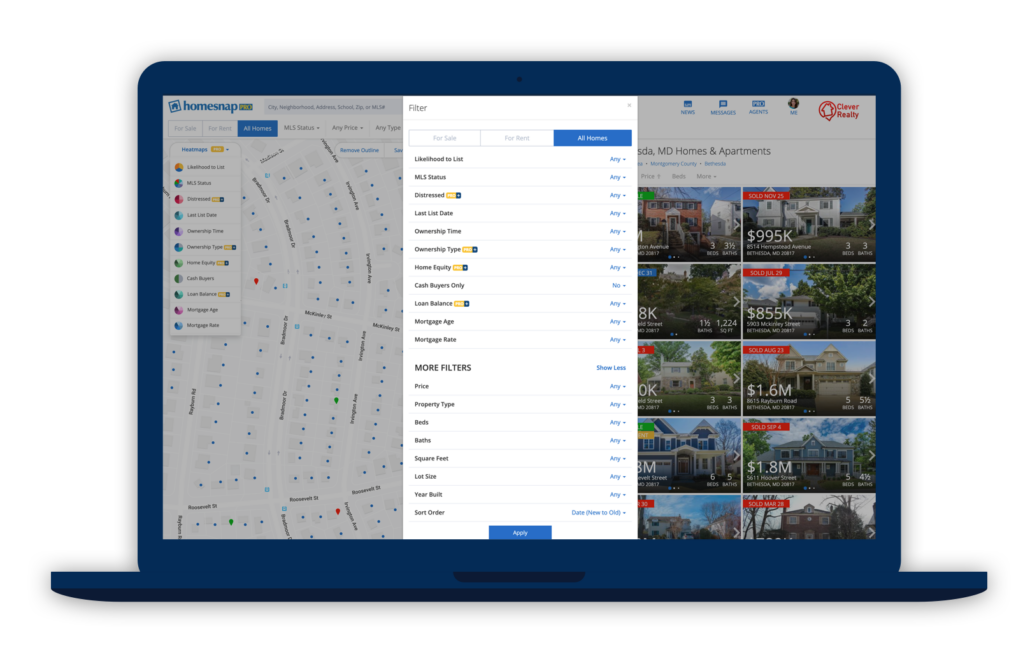

You’ll see the traditional search filters, as well as new property filters so you can search by Ownership Time, Last List Date, Mortgage Rate and Age, Likelihood to List, and more.

2) Enable property heatmaps.

After you set up your search, you’ll see a button in the lower-left corner that says “Heatmaps.” This gives you the opportunity to see those same search filters as color-coded heatmaps instead of just dots on the map. This is what it looks like if you use heatmaps to search for properties based on Likelihood to List score.

3) Explore property information.

Click into one of the properties that’s orange, or Most Likely to List. Check out all the information at your fingertips — net equity, mortgage rates, ownership status.

4) Click on a homeowner profile.

See if the homeowner’s email or phone number are listed. Homesnap Pro+ members will also have special access to see any attached social media profiles, which provide additional avenues for outreach.

This is the smartest and most efficient way to find seller leads, and you can do it all for free. Download Homesnap today — available on iOS and Android — and also available on your computer.

Your ballot will be mailed to you with a stamped return envelope if you’re registered by March 2, or it can be handed to you or printed from an online file if registering after March 2.

Your ballot will be mailed to you with a stamped return envelope if you’re registered by March 2, or it can be handed to you or printed from an online file if registering after March 2.